Austin paycheck calculator

There is a line on the W-4 that allows you to specify additional withholding. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Calculation Of Federal Employment Taxes Payroll Services

How You Can Affect Your Utah Paycheck.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages. How You Can Affect Your Minnesota Paycheck.

How Your Ohio Paycheck Works. That includes overtime bonuses commissions awards prizes and retroactive salary increases. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Overview of Nebraska Taxes Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status. Overview of Maryland Taxes Maryland has a progressive income tax system with rates that range from 200 to 575.

How You Can Affect Your Texas Paycheck. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

So your big Texas paycheck may take a hit when your property taxes come due. We assume that the contribution limits for your retirement accounts increase with inflation. A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals.

Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

How Your California Paycheck Works. How You Can Affect Your Vermont Paycheck. Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A primary way in which you can affect your Utah paycheck is by adjusting your withholdings. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Your household income location filing status and number of personal exemptions. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. How You Can Affect Your Alabama Paycheck.

How You Can Affect Your Louisiana Paycheck. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The simplest way to change how much tax is withheld from your paycheck is to ask your employer to withhold a specific dollar amount from each of your paychecks.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Your job probably pays you either an hourly wage or an annual salary. How You Can Affect Your West Virginia Paycheck.

In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals. A financial advisor in Louisiana can help you understand how taxes fit into your overall financial goals. You cant escape your income taxes but you can take.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. If you really want to avoid owing.

A financial advisor in Minnesota can help you understand how taxes fit into your overall financial goals. We automatically distribute your savings optimally among different retirement accounts. If you consistently find yourself owing.

Average prices of more than 40 products and services in United States. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Your household income location filing status and number of personal exemptions.

Your household income location filing status and number of personal exemptions. Overview of Kansas Taxes There are three tax brackets in the Sunflower State with your state income tax rate depending on your income level. Your household income location filing status and number of personal exemptions.

If you want to adjust the size of your paycheck first. If you want to shelter more of your earnings from taxes. We assume you will live to 95.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. But unless youre getting paid under the table your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

We stop the analysis there regardless of your spouses age. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding. Prices of restaurants food transportation utilities and housing are included.

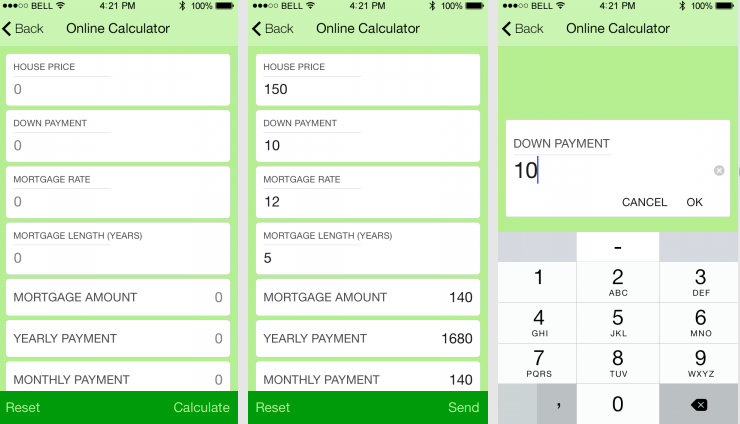

Say for example you want to withhold 50 from each paycheck. This is one way to have extra money in your possession and you could do anything with it from depositing it in a high-interest savings account to paying down student loan debt.

4 Ways To Calculate Annual Salary Wikihow

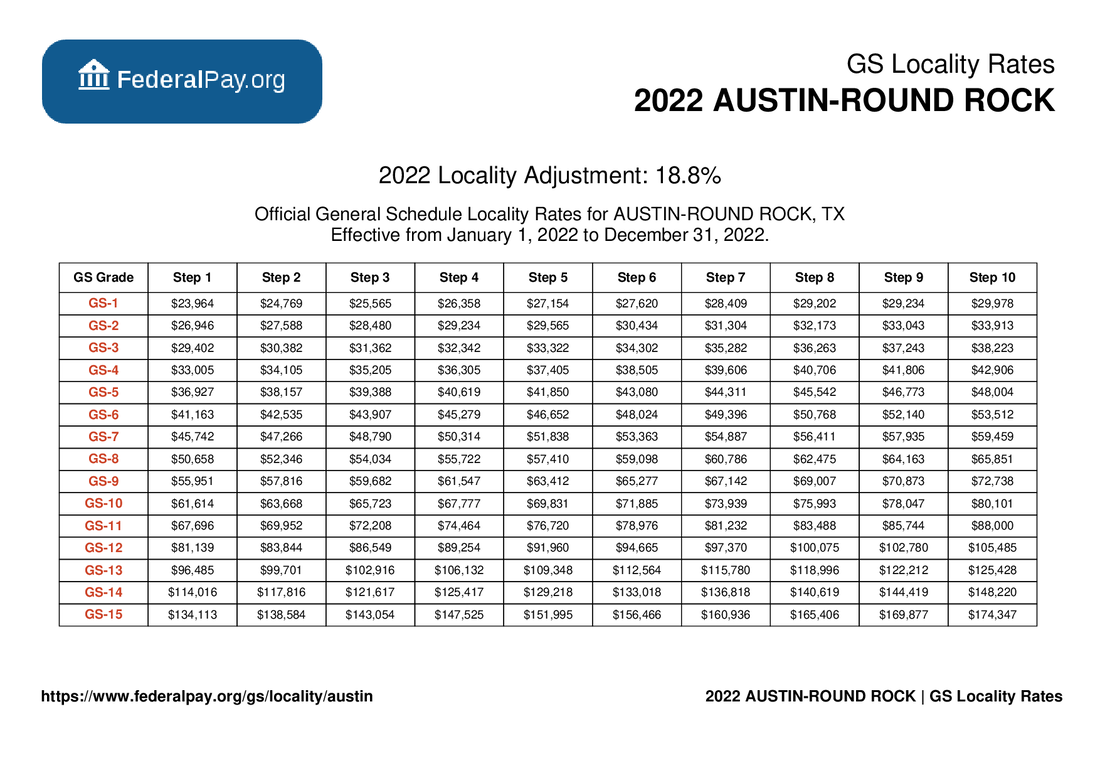

Austin Pay Locality General Schedule Pay Areas

Texas Paycheck Calculator Smartasset

Hourly To Salary Calculator Convert Your Wages Indeed Com

Indeed Salary Calculator Indeed Com

Indeed Salary Calculator Indeed Com

Texas Paycheck Calculator Smartasset

Texas Paycheck Calculator Adp

Adp Salary Paycheck Calculator Sale Online 56 Off Www Ingeniovirtual Com

Equivalent Salary Calculator By City Neil Kakkar

Adp Salary Paycheck Calculator Sale Online 56 Off Www Ingeniovirtual Com

Adp Salary Paycheck Calculator Sale Online 56 Off Www Ingeniovirtual Com

Adp Salary Paycheck Calculator Sale Online 56 Off Www Ingeniovirtual Com

Adp Salary Paycheck Calculator Sale Online 56 Off Www Ingeniovirtual Com

Here S How Much Money You Take Home From A 75 000 Salary

4 Ways To Calculate Annual Salary Wikihow

Texas Paycheck Calculator Adp